Calculate How Much Intital Investment Compounded Continuously

Continuously Compounded Return

A mathematical limit that the interest can reach when it is calculated and reinvested back into the account for an infinite number of periods

What is Continuously Compounded Return?

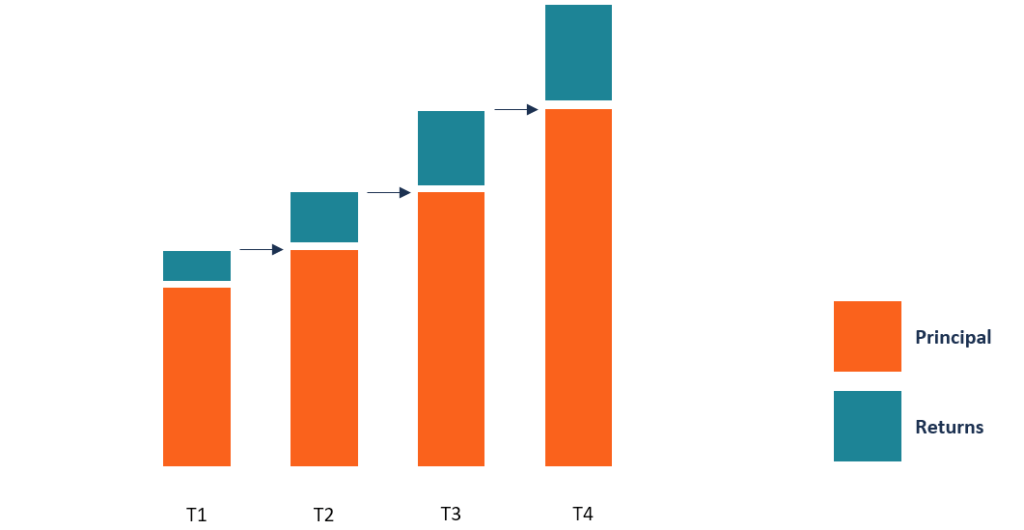

Continuously compounded return is what happens when the interest earned on an investment is calculated and reinvested back into the account for an infinite number of periods. The interest is calculated on the principal amount and the interest accumulated over the given periods and reinvested back into the cash balance.

Regular compounding is calculated over specific time intervals such as monthly, quarterly, semi-annually and on an annual basis. Continuous compounding is an extreme case of this type of compounding since it calculates interest over an infinite number of periods, rather than assuming a specific number of periods. The difference between the interest earned through the traditional compounding method and the continuous compounding method may be significant.

Annual Compounding vs. Continuously Compounded Return

Investors calculate the interest or rate of return on their investments using two main techniques: annual compounding and continuous compounding.

Annual compounding

Annual compounding means that the return on an investment is calculated every year, and it is different from simple interest. The annual compounding method uses the following formula:

Total = [Principal x (1 + Interest)] ^Number of years

The return on investment is obtained by deducting the principal amount from the total returns obtained using the above formula.

Assume that Company ABC invested $10,000 to purchase a financial instrument, and the rate of return is 5% for two years. Therefore, the interest earned from ABC's investment for the two-year period is as follows:

= [10,000 x (1+0.05)^2

= (10,000 x 1.1025)

= 11,025 – 10,000

= $1,025

Therefore, Company ABC earned interest of $1,025 on its investment of $10,000 over two years.

Continuously Compounded Return

Unlike annual compounding, which involves a specific number of periods, the number of periods used for continuous compounding is infinitely numerous. Instead of using the number of years in the equation, continuous compounding uses an exponential constant to represent the infinite number of periods. The formula for the principal plus interest is as follows:

Total = Principal x e^(Interest x Years)

Where:

- e – the exponential function, which is equal to 2.71828.

Using Company ABC example above, the return on investment can be calculated as follows when using continuous compounding:

= 10,000 x 2.71828^(0.05 x 2)

= 10,000 x 1.1052

= $11,052

Interest = $11,052 – $10,000

= $1,052

The difference between the return on investment when using continuous compounding versus annual compounding is $27 ($1,052 – $1025).

Daily, Monthly, Quarterly, and Semi-annual Compounding

Apart from the annual and continuous compounding methods, interest can also be compounded at different time intervals such as daily, monthly, quarterly and semi-annually.

To illustrate compounding at different time intervals, we take an initial investment of $1,000 that pays an interest rate of 8%.

Daily compounding

The formula for daily compounding is as follows:

= Principal x (1+Interest/365)^365

= 1,000 x (1 + 0.08/365) ^ 365

= 1,000 x (1 + 0.00022)^365

= 1,000 x (1.00022) ^ 365

= 1,000 x 1.0836

= $1,083.60

Monthly compounding

The formula for the monthly intervals is as follows:

= Principal x (1+Interest/12)^12

= 1,000 x (1+0.08/12) ^12

= 1,000 x [1+0.0067)^12

= 1,000 x (1.0067)^12

= 1,000 x (1.083)

= $ 1,083.00

Quarterly compounding

The formula for quarterly compounding is as follows:

= Principal x (1 + interest/4)^4

= 1,000 x (1 +0.08/4)^4

= 1,000 x (1 + 0.02)^4

= 1,000 x (1.02)^4

= 1,000 x 1.0824

= $1,082.40

Semi-annual compounding

The formula for semi-annual compounding is as follows:

= Principal x (1 + interest/2)^2

= 1,000 x (1 + 0.08/2)^2

= 1,000 x (1 + 0.04)^2

= 1,000 x (1.04)^2

= 1,000 x 1.0816

= $1,081.60

Conclusion on Compounding Intervals

From the above calculations, we can conclude that all the intervals produce an almost equal interest, but with a small variation. For example, quarterly compounding produces an interest of $82.40, which is slightly higher than the interest produced by semi-annual compounding at $81.60.

Also, the monthly rate yields an interest of $83, which is slightly higher than the interest produced by quarterly rates at $82.40. Daily compounding yields a higher interest of $83.60, which is slightly higher than the interest at monthly rates of $82.60.

From the pattern above, we can also say that small interest compounding intervals produce higher interest rates compared to large compounding intervals.

Importance of Continuous Compounding

Continuous compounding offers various benefits over simple interest and regular compounding. The benefits include:

1. Reinvest gains perpetually

One of the benefits of continuous compounding is that the interest is reinvested into the account over an infinite number of periods. It means that investors enjoy the continuous growth of their portfolios, as compared to when they earn interest monthly, quarterly, or annually with regular compounding.

2. Interest amount will keep on growing

In continuous compounding, both the interest and the principal keep on growing, which makes it easier to multiply the returns in the long term. Other forms of compounding only earn interest on the principal and that interest is paid out as it is earned. Reinvesting the interest allows the investor to earn at an exponential rate for an infinite number of periods.

Additional Resources

Thank you for reading CFI's guide on Continuously Compounded Return. To keep learning and advancing your career, the following CFI resources will be helpful:

- Annual Percentage Rate (APR)

- Compound Annual Growth Rate (CAGR)

- Interest Rate Calculator

- Principal Payment

rotherhimbeyer1998.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/continuously-compounded-return/

0 Response to "Calculate How Much Intital Investment Compounded Continuously"

Post a Comment